What Is The Lifetime Health Cover Loading In Australia?

Key Points

Lifetime Health Cover loading applies to anyone who doesn't get hospital cover on or before the 1st July following their 31st birthday but then takes out eligible hospital insurance later in life.

You'll get a 2% LHC loading surcharge for every year you don't take out eligible hospital insurance once you turn 31.

LCH loading applies to hospital cover only -- it doesn't apply to extras or ambulance cover.

Lifetime Health Cover (LHC) is a government initiative that encourages people to take out health insurance earlier in life and maintain it.

If you don't take out hospital cover before you're 31, you'll pay a 2% Lifetime Health Cover 'loading' (basically, a fee).

Another 2% will be added for each year you go without hospital cover.

Getting eligible hospital insurance before you're 31 can save you money in the long run.

And if you're over 31, taking out hospital cover now will minimise the financial impact of LHC.

COMPARE & SAVEWhy do I have to pay Lifetime Health Cover loading?

Lifetime Health Cover (LHC) loading is a 2% surcharge that exists to encourage people to take out hospital cover from a younger age.

The idea is that it will help reduce the burden on the public health system.

The Australian Government launched the LHC initiative in 2000.

How much will Lifetime Health Cover loading cost if I'm over 31?

If you don't have hospital cover by the 1st of July following your 31st birthday (also known as your 'LHC base day'), the lifetime loading fee will apply when you eventually take out eligible hospital insurance.

You'll get an extra surcharge on top of your premium for every year you don't take out hospital cover after your 31st birthday. Once you take out hospital cover, the applicable LHC loading is payable for 10 years.

Here's what percentage you'll have to pay on your premiums based on how old you are when first take out hospital cover:

Age | LHC Loading |

|---|---|

31* | 2% |

35 | 10% |

40 | 20% |

45 | 30% |

50 | 40% |

55 | 50% |

60 | 60% |

65 | 70% |

The maximum LHC loading that anyone can pay is 70%, and the loading stops after 10 years of continuous hospital cover.

Are there any exceptions to Lifetime Health Cover loading?

You don't have to pay the Lifetime Health Cover loading if any of the following apply to you:

You're under 31.

You took out hospital cover within 12 months of registering for Medicare after moving to Australia.

You were born on or before 1 July 1934

You are a member of the Australian Defence Force and considered to have hospital cover (unless you're discharged from the ADF before you turn 31).

You hold a Department of Veterans' Affairs Gold Card.

The government also allows you 'Days of Absence'.

This is if you've previously held hospital cover but then stop for whatever reason.

An example of this would be if you decide to switch health insurers but only hold an extras policy with the new insurer.

You're allowed a total of 1094 Days of Absence (just under three years) during your lifetime.

If you use up your Days of Absence then you'll pay the LHC when you take out a new hospital cover policy.

You'll get an additional 2% loading each year on top of any loading you already have.

If you suspend your hospital cover due to a long overseas holiday, for example, or move overseas for a year or more, then this won't count towards your Days of Absence.

COMPARE & SAVEHow can I prove my Lifetime Health Cover loading cost if I need to?

You'll need to prove what LHC loading you've been paying, if any, when you switch health funds.

You'll need to ask your old health fund for a Clearance Certificate that confirms your LHC loading status.

You then pass the certificate to your new health fund.

If you switch funds via Compare Club, we'll take care of all the paperwork, including your Clearance Certificate.

How does Lifetime Health Cover loading work if I move to a couples or family policy?

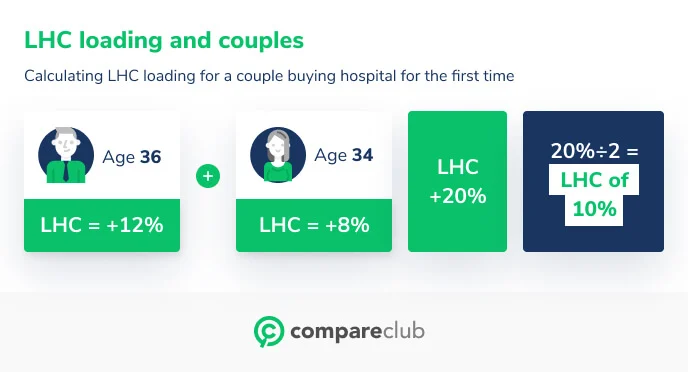

If you want to take out a couples or family policy, LHC loading is calculated by adding up your and your partner's individual LHC loading rates and dividing the sum in half (to get the average).

Here's an example:

Does switching health funds affect my Lifetime Health Cover loading?

In short, no. You can take a break from having hospital cover for a total of 1094 days without it having any effect on your LHC loading.

I moved to Australia after I turned 31. Do I need to pay Lifetime Health Cover loading?

Yes, but you won't have to pay immediately.

If you take out hospital cover within 12 months of registering for Medicare, you'll avoid LHC, no matter how old you are.

But if you miss that deadline then you'll have to pay a loading fee of 2% for every year you are aged over 30 and haven't held cover, no matter how old you are.

I'm moving overseas. Will this affect my hospital cover loading fee?

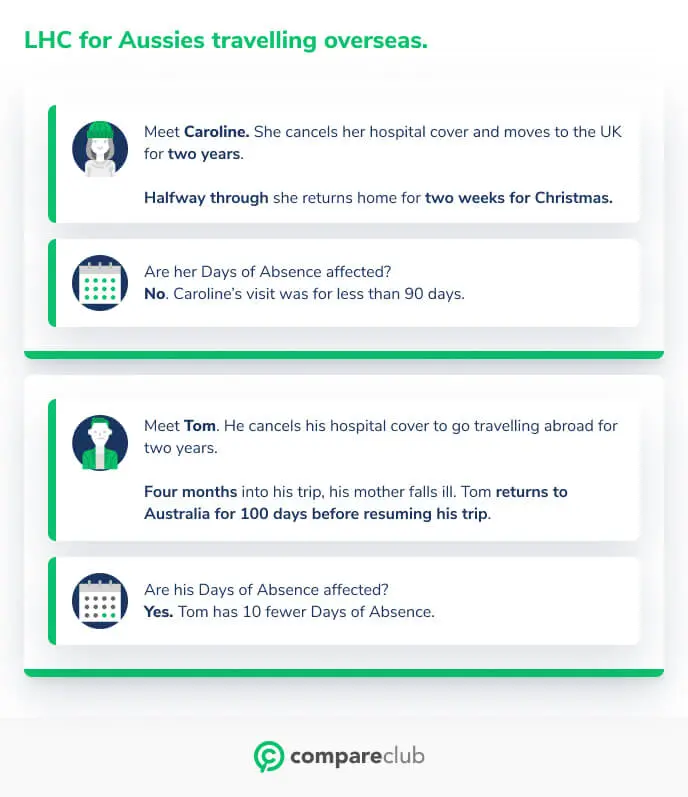

Provided you're living abroad for more than a year, then your LHC won't be affected.

You can also return to Australia for up to 90 days at a time and this won't count towards your Days of Absence.

If you're in Australia for longer than 90 days, then you're no longer considered to be overseas and this will eat into your Days of Absence.

Should I consider private health insurance to avoid Lifetime Health Cover loading?

The short answer is yes, if you think you may want to take out hospital cover at any time during your lifetime.

This will help you avoid high health insurance costs in the future.

The good news is that most health insurers offer lower-tier basic and bronze level hospital cover.

These are designed to be affordable and tax efficient and will also help you avoid the Medicare Levy Surcharge, if you earn over $90,000 or $180,000 as a couple.

What's more, many of these lower tier policies still come with some inclusions -- often for items such as dental surgery -- and you'll probably get emergency ambulance cover included as well.

This can be very helpful if you live in a state like Victoria, where residents have to pay for ambulance services.

But even some Basic and Bronze policies are better than others.

It's why it can be worth speaking to one of our specialists at Compare Club, who can make sure you're getting value for money.

How can I make sure I don't overpay on health insurance?

That's easy -- compare health insurance with us. This way you can get hospital cover that offers all the items you need at a price you can afford.

In the last decade, we've saved Australians, on average, $358.29 on their health insurance.

What's the best health insurance for avoiding the Lifetime Health Cover loading charge?

There is no 'best' health insurance if you're looking to avoid LHC loading, although you'll need to make sure you've taken out hospital cover, rather than just an extras cover policy.

Each fund will offer different levels of cover at a range of prices.

It's worth taking the time to compare your options.

This way, you'll be able to find the right cover for you and your budget.

We can help you find a policy that suits you needs and your bank balance from our panel of trusted insurers.

Lifetime Health Cover loading is relatively straightforward when you understand how it works.

But finding the right policy can still be complicated, which is why it's worth comparing health funds.

And if you think you'll ever need hospital cover, it pays to take out a policy sooner rather than later!

Related Article

What Is The Lifetime Health Cover Loading In Australia?

COMPARE & SAVEThings You Should Know

*Over 137,000 customers who switched with Compare Club between 2018 - 2022 saved an average of $300 off their annual premium.

*As our customer you'll be provided with quotes directly from the insurer for the product you intend to purchase. We manage the application and deal with the administration work and insurer. We do not charge you a fee for the service we provide, the insurer simply remunerates us in return for setting up your policy. The financial and insurance products compared on this website do not necessarily compare all features that may be relevant to you. Comparisons are made on the basis of price only and different products may have different features and different levels of coverage. Compare Club does not compare all policies available in Australia and our partner insurers may not make all policies available to Compare Club.

This guide is opinion only and should not be taken as medical or financial advice. Check with a financial/medical professional before making any decisions.

Chris Stanley is the sales & operations manager of health insurance at Compare Club. With extensive experience and expertise, Chris is a trusted leader known for his deep understanding of health insurance markets, policies, and coverage options. As the sales & operations manager of health insurance, Chris leads a team of dedicated professionals committed to helping individuals and families make informed decisions about their health insurance needs.

Meet our health insurance expert, Chris Stanley

Chris's top health insurance tips

- 1

Australia’s public health system is world-class, but wait times for public hospitals can be long, inconvenient - and leave you living in constant pain while you wait.

- 2

An appropriate private health insurance policy can speed up your surgery, relieving your pain sooner.

- 3

Family health cover means your children are covered under the same policy as you.

- 4

Many health insurance policies come with a 12-month waiting period for pregnancy-related cover, so it’s a good idea to get a family policy organized well before starting your family. This means your child will be covered from birth until at least their early twenties (depending on which health fund you select).